In an earlier article, we understood how the economy works through transactions. Transactions can be made through cash or with credit. In this article, we will understand what is credit and how it helps the economy to grow.

Credit:

Credit is the most important part of the economy and probably the least understood. Just like buyers and sellers go to the market to make transactions likewise lenders and borrowers do.

Lenders usually want to make a return on their money and borrowers usually want to buy something they can’t afford. Ex: Buying a house, a crore to meet their wants and needs, or to set up a business.

“Credit helps both lenders and borrowers to get what they want”

Borrowers promise to repay the amount they borrow with an additional amount called interest. When the interest rates are high borrowing will be less because it’s expensive. When interest rates are lower, borrowing will be higher because it’s cheaper. When a borrower promises to repay and the lender believes then the credit is created. Borrowers spend that money and remember spending drives the economy. Because one person’s spending is another person’s income.

How Credit Drives Economic Growth

When the borrower receives the credit, he is able to increase his spending and remember spending drives the economy. This is because one person’s spending is another person’s income. Every rupee you spend someone else earns. Every rupee you earn someone else has spent.

So increased income allows increased borrowing which in turn leads to increased spending. Since one person’s spending is another person’s income. This leads to increased borrowing and so on.

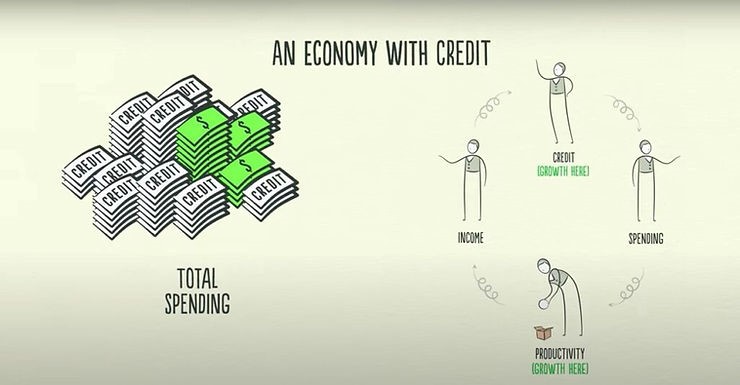

So increased income allows increased borrowing which in turn leads to increased spending. Since one person’s spending is another person’s income. This leads to increased borrowing and so on. So credit plays a very important role in economic growth as it allows people to spend more even though not having money. The total amount of credit in India is about 2lak crores. Remember in an economy without credit the only way to increase spending is to produce more. But in an economy with credit, you increase your spending by borrowing. As a result economy with credit has more spending and allows income to rise faster than productivity

Credit Isn’t Bad :

As the economy grows much faster with credit, at the same time it creates a liability called “Debt”. You might say that debt is bad and should be gotten out of. Credit is bad if you finance for overconsumption that can’t be paid off. However, it’s good when it efficiently allocates resources and produces income so you can pay back the debt. For Example: If you borrow money to buy a big TV, it doesn’t generate income to pay back your debt.

But if you borrow to buy a tractor and that tractor lets you harvest more crops and earn more money then you can pay back your debt and improve your standard of living

So credit is good if we finance it for income-generating assets and it is going to be a bad investment when finance it for unproductive purposes.