Albert Einstein the renowned scientist had said… Compound interest is the eighth wonder of the world. He who understands it earns it and….. he who does not, pays it.

Luckily for us, we do not need the intelligence of Albert Einstein to understand the power of compound interest! This simple concept is taught in high school.

In this article, we’ll break down exactly how compound interest works with simple, step-by-step examples.

So take a deep breath, grab a snack to munch on, and let’s figure out this compound interest thing together. You got this!

What is Compound Interest Anyway?

Let’s start with basic definitions:

The word compounding means that the initial returns or interest that you earned on investment becomes part of the invested capital or principle.

Compounding takes place when the returns or interest generated on the principal amount in the first period is added back to the principal amount in order to calculate the interest for the following periods.

For example, say you invest Rs 1,000 at a 5% annual interest rate. After the first year, you’ll earn 5% interest on your Rs 1,000, which is Rs50.

Now you have Rs1,050 total in your account.

The next year, you’ll earn 5% interest on the entire Rs 1,050 balance. That interest earned will be added back to your total balance, and then next year you’ll earn interest on an even larger balance, and so on.

This is different from simple interest, where interest is only calculated on the original principal amount — so you’d keep earning Rs 50 each year on your original Rs 1,000 investment at a 5% interest rate with simple interest.

The cool thing about compound interest is that your money starts to snowball quickly, earning you more and more interest every year assuming you are saving rather than borrowing. But we’ll see some examples of that in action soon enough!

Say you invest Rs 1,000 at a 5% annual interest rate, with interest compounded annually.

Year 1:

- You earn 5% of Rs 1,000, which is Rs 50.

- Your total balance is now Rs1,000 + Rs 50 = Rs 1,050

Year 2:

- You earn 5% of Rs 1,050, which is Rs 52.50

- Your total balance is now Rs 1,050 + Rs 52.50 = Rs 1,102.50

Year 3:

- You earn 5% of Rs 1,102.50, which is Rs 55.13

- Your total balance is now Rs 1,102.50 + Rs 55.13 = Rs 1,157.63

And so on…

Start Saving Early for Compounding Power

One of the coolest things about compound interest is that time is your best friend.

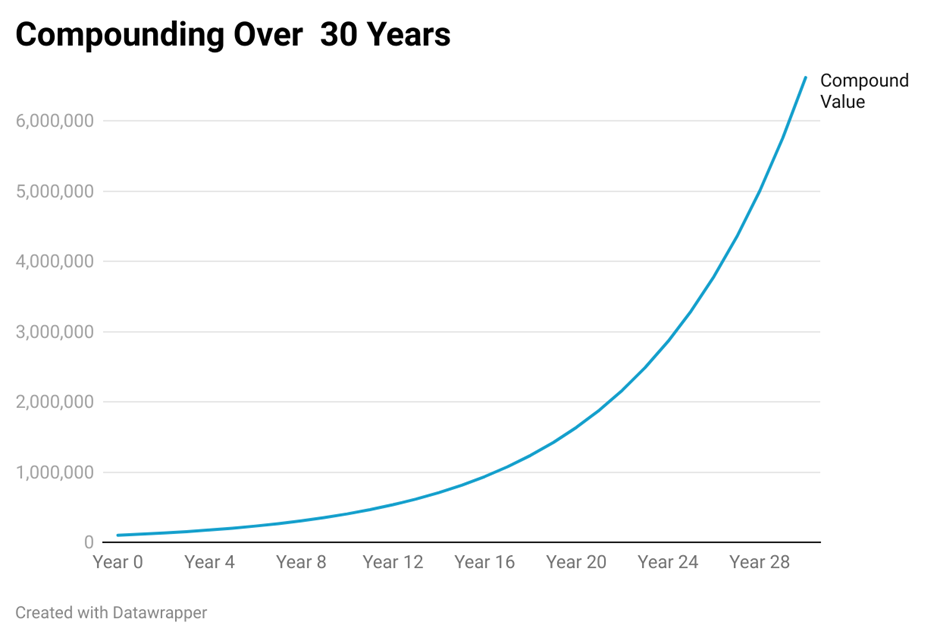

Rs 1,00,000 invested at 15% compounding grows to Rs 66,00,000 by the end of 30 years as the same 1 lakh would have grown to Rs 5,50,000 with simple interest.

The longer you save and invest, the more time your money has to compound and grow. This is why financial experts always recommend starting retirement savings as early as possible.

Congrats, you now know more about compound interest than most people walking around out there so use this knowledge to improve your future self’s financial well-being.

Hopefully, this gave you a solid foundation for understanding and harnessing the incredible power of compound interest. Your future rich self thanks you.

Now go forth and start letting your money work for you.

Compound Interest Investment Options

Many different savings and investment products utilize the power of compound interest. Common options include:

- Index funds

- Mutual funds

- Stocks

The right option depends on your goals, timeline, and risk tolerance. Do your research to find the best fit for you!

Happy compounding.