History Of Bank:

The Housing Development Finance Corporation Limited or HDFC was among the first financial institutions in India to receive an “in principle” approval from the Reserve Bank of India (RBI) to set up a bank in the private sector. This was done as part of RBI’s policy for liberalization of the Indian banking industry in 1994.HDFC Bank was incorporated in August 1994 in the name of HDFC Bank Limited, with its registered office in Mumbai, India. The bank commenced operations as a Scheduled Commercial Bank in January 1995.

HDFC Bank is one of India’s leading private banks and was among the first to receive approval from the Reserve Bank of India (RBI) to set up a private sector bank in 1994.

Today, HDFC Bank has a banking network of 5,345 branches and 14,533 ATMs spread across 2,787 cities and towns

Business Segments :

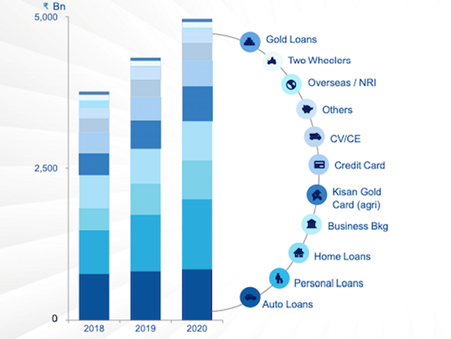

Retail Banking :

The retail banking segment serves retail customers through the Bank’s branch network and other channels. This segment raises deposits from customers and provides loans and other services to customers with the help of specialist product groups

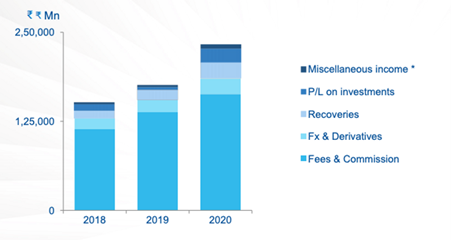

Revenues of the retail banking segment are derived from interest earned on retail loans, interest earned from other segments for surplus funds placed with those segments, subvention received from dealers and manufacturers, fees from services rendered, foreign exchange earnings on retail products, etc

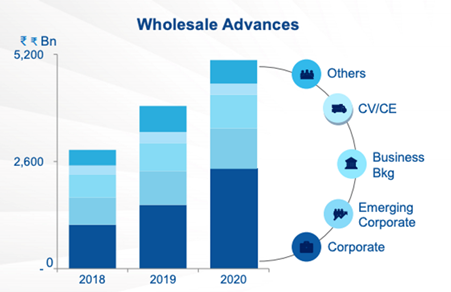

Wholesale Banking :

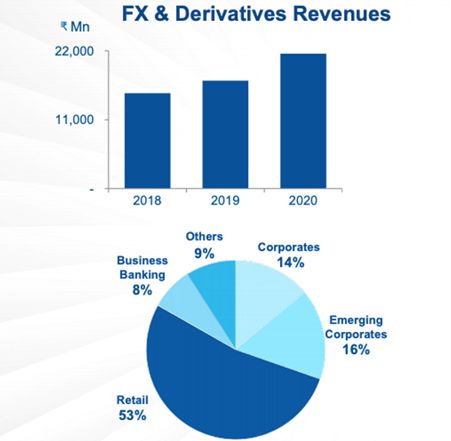

The wholesale banking segment provides loans, non-fund facilities, and transaction services to large corporates, emerging corporates, public sector units, government bodies, financial institutions, and medium-scale enterprises. Revenues of the wholesale banking segment consist of interest earned on loans made to customers, interest/fees earned on the cash float arising from transaction services, earnings from trade services and other non-fund facilities, and also earnings from foreign exchange and derivative transactions on behalf of customers

Treasury:

The treasury segment primarily consists of net interest earnings from the Bank’s investment portfolio, money market borrowing and lending, gains or losses on investment operations, and on account of trading in foreign exchange and derivative contracts.

Other Revenues:

This segment includes income from para-banking activities such as credit cards, debit cards, third-party product distribution, primary dealership business, and the associated costs.

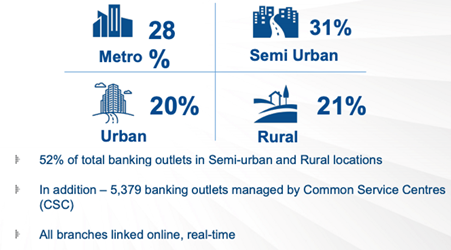

Unparallel Reach:

Hdfc Bank has the widest reach among private sector banks in India. Our large network enables us to serve our customers better and participate actively in the development of the communities around us.

1. Staying close to customers

The Bank network comprises banking outlets, ATMs including cash deposit and withdrawal machines (CDMs), Common Service Centres (CSCs) which include village-level entrepreneurs (VLEs) and business Correspondents (BCs), and merchants

2. Semi-urban and Rural India Network :

Financial Performance :

Hdfc Bank has posted consistent PAT growth of 21% yearly. It posted growth irrespective of the several crises throughout the decade

Key Metrics:

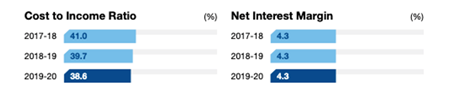

The bank maintained key ratios that grew consistently stronger during the year. The bank adopted a holistic approach while conducting all business activities with a sharp eye on return on investments. This approach yields dividends

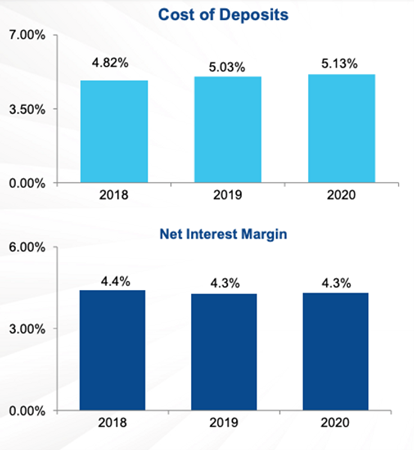

Low Funding Cost :

HDFC Bank has the lowest deposit costs in the industry, which means the bank is able to raise funds at much lower rates than other banks. Healthy margins mean relatively stable across interest rates & economic cycles

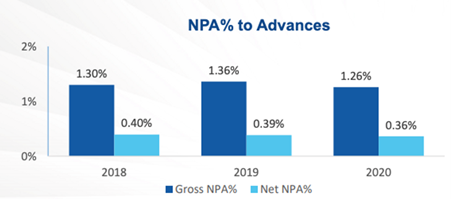

Asset Quality :

Hdfc Bank has the best portfolio quality (wholesale & retail) in the industry. Strong credit culture, policies, and processes have helped the bank to keep the NPAs low in the industry.

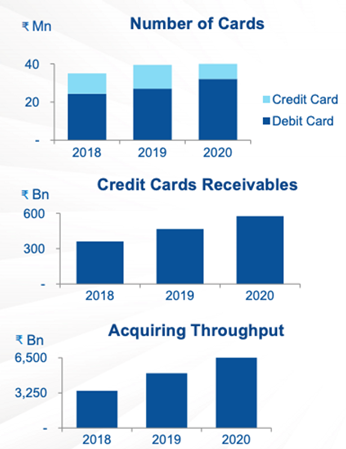

Market Leader in Cards :

Hdfc Bank is the Market leader in credit cards. The bank has issued 14.5 mn credit cards. Over 80% of new credit cards are issued to existing customers. Merchant acquiring – over 8,70,000 POS terminals. Leading provider of payment gateway services

Leveraging Technology :

Since the beginning Hdfc Bank has been a pioneer in building a technology-led bank and one of the first banks to offer Net-banking services, 10-sec personal loans, app banking, and now WhatsApp banking.

Now 95% of bank customers are transacting through Internet and mobile banking. Only 3% of the customers walk into the branch

5 Trillion Dollar Opportunity:

As we are heading towards a 5 trillion dollar economy the largest bank size could be around 400 to 500 billion dollars means roughly 25 to 30 lakh crores. Now the market cap of the bank is around 5 lakh crores. There is an opportunity of growing 5 to 6 times. After the Yes Bank collapse bank witnessed an inflow of Rs 80,000 crores which helped to gain market share.

Challenges:

Because of this pandemic, there could be a deceleration in GDP growth that is likely to rein in the demand for credit and compromise credit quality. The rise of credit risk means an increase in defaulters. A rise in unemployment may lead to a dip in credit demand in the retail segment. Change in the management as M.D Aditya Puri is retiring in November this year.

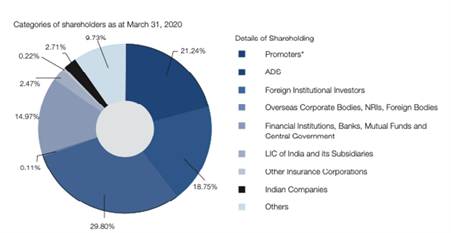

Shareholding Pattern :

Conclusion:

Hdfc Bank is well positioned to ride the massive growth opportunities and leverage digitization. The bank placed a massive risk management system in place to control the NPAs among its peers.

#econoomy #creditcards #analysis #marketleader #5trilliondollaropportunity #Banking #hdfcbank