About DMart:

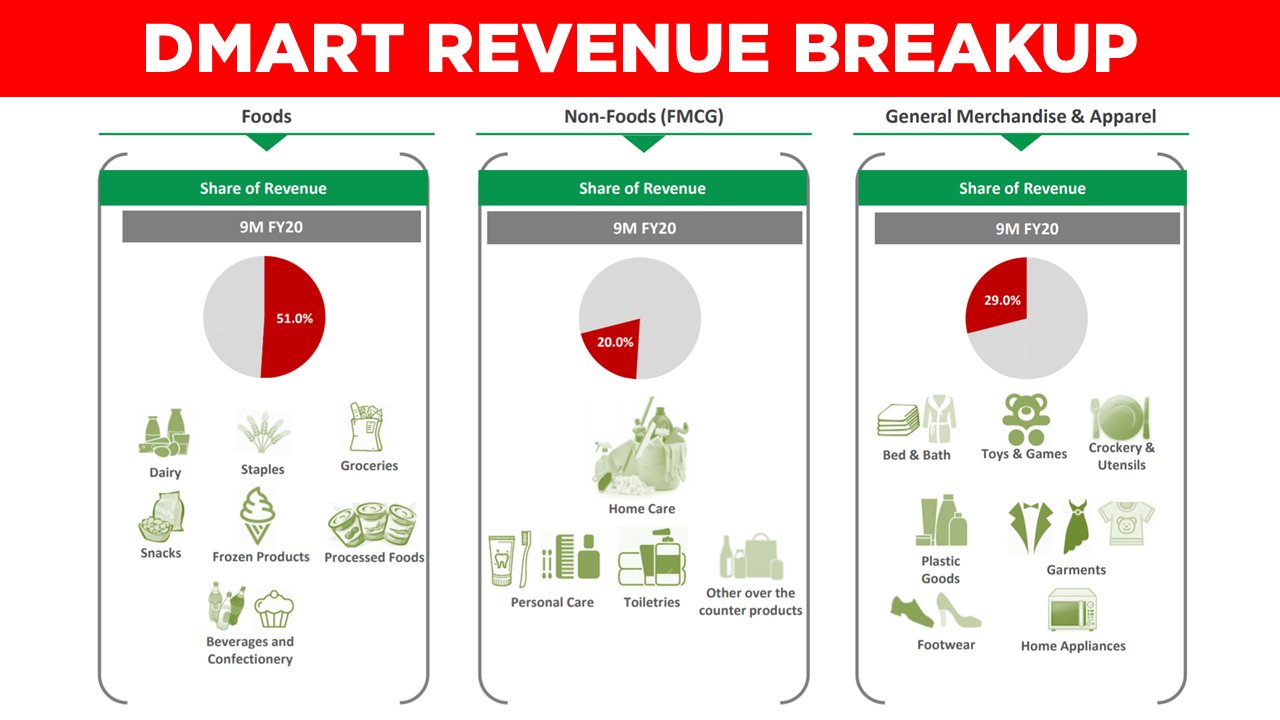

Avenue Super Marts Limited is a Mumbai-based company, which owns and operates D-Mart stores. D-Mart is a national supermarket chain with a focus on value retailing. The Company offers a wide range of products with a focus on Foods, Non-Foods (FMCG), and General Merchandise and apparel product categories. The Company offers its products under various categories, such as grocery and staples, daily essentials, processed foods and beverages, snacks, dairy and frozen, home and personal care, bed and bath, crockery, toys and games, and apparel for kids, ladies, and men.

Segment-wise Revenue:

Stores Expansion:

The total number of stores is 214 across the country. In 2016 the company had 110 stores and it expanded to 131 stores in 2017 and to 176 stores in 2019. Due to rapid urbanization and an increase in income in rural areas, D-Mart is adding stores aggressively.

Financial Performance:

D-Mart posted steady profits since the start of the business. D-Mart has posted a sales CAGR of 33% in the past 5 years and a profit of 41%. The company has successfully converted sales into cash which resulted in steady cash flows

What Makes D-Marts Unique among Others:

DMart is among the few retailers that is growing constantly and is profitable. Let us know what is the secret sauce of DMart and how it is able to offer EVERYDAY LOW PRICE(EDLP)

Space Utilization:

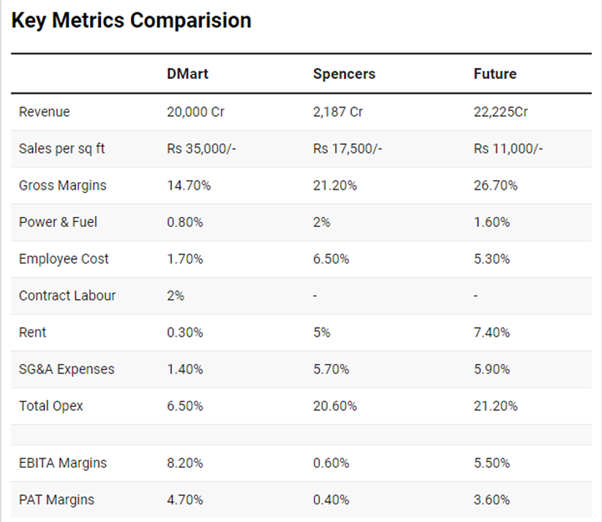

D mart sales per sq ft is Rs 33800/- which is the highest in the industry. It uses the space in its stores to the fullest. Whereas Spencer’s sales per sq ft is Rs 17,500/- and for the future is Rs 11,000/-. Companies are able to sell more goods in less space. They in turn pass the savings to customers through daily discounts

Owned Store Model:

DMart owns most of the land or enters into a long-term lease to keep the rent expenses low. The rent expenses are just 0.3% of the revenue. Companies will not open stores in fancy areas to avoid the high investment in land and rent

Inventory:

Efficient inventory management is critical for profitability in the retail business. Dmart is careful in inventory buying ( and high sales throughout), they see much higher inventory than others. As a result, they have shorter credit cycles and are able to negotiate better pricing from suppliers

Own Products:

Recently D mart started selling its own brands which they themselves manufacture of high sale products which has high-margin

E.g.: Dmart Minimax, Dmart Premia, D Homes, etc

Regional Products:

Dmart identifies and sells the regional food items that attract the customers

Slotting Fees:

Dmart charges the slotting fee from the manufacturers to display their products

Supply chain management:

D Mart largely relies on the local suppliers rather than far suppliers and the supply chain itself is reduced. DMART makes upfront payments to suppliers and logistics providers, which helps to maintain strong relationships and achieve lower costs

Peer Comparison:

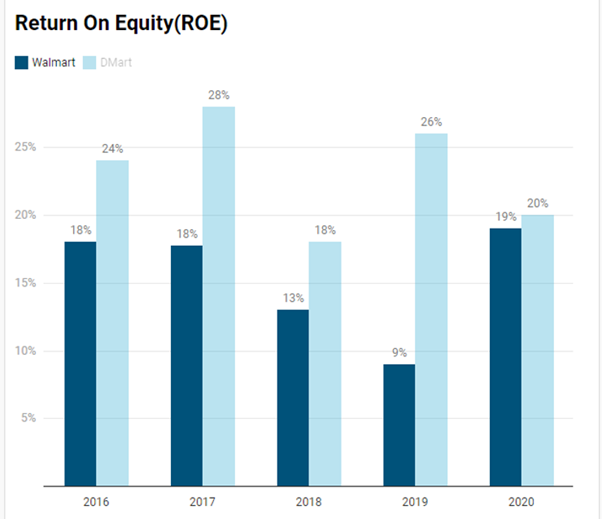

The high resemblance between Walmart and DMART:

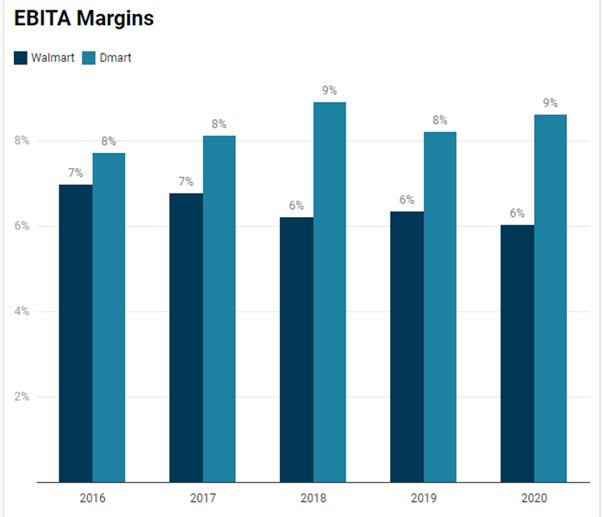

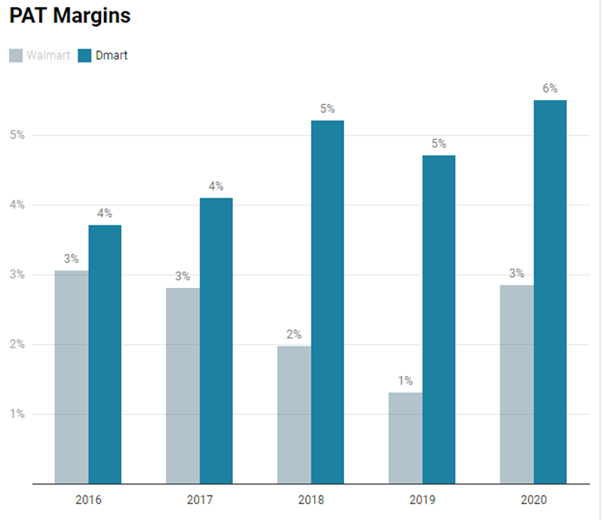

DMART resembles the performance and track record of the world’s largest and most successful retailer, ‘Walmart. D’Mart And Walmart have a common philosophy of EVERYDAY LOW PRICES. Both are offering the products at low prices as compared to other retailers. Walmart has showcased consistent performance in terms of margins and return ratio over the last 30 years. It maintained EBITA margins in the range of 6-7% whereas DMart’s margins 7-9% range.

DMart is trading at a high PE of 133 whereas Walmart’s PE is 26.40. DMart is one of the few stocks that is trading at high PE

Opportunities:

The rising income levels of people means a high amount of disposable income in the hands of people With~66% of India’s population below 35 years, India’s median age was estimated at ~28 years compared to a global average of 30 in 2019, driving aspiration and consumption-led retail off take. The consumption pattern of India is seeing a paradigm shift from price sensitivity to a superior price-value proposition

Challenges:

An increase in raw material costs, DMART’s unable to pass it on, and subdued consumption levels would hamper revenue Any slowdown in store expansion will lead to slow growth DMart major revenue comes from Maharashtra where prolonged lockdowns will hurt the earnings. Change in customers’ behavior of avoiding walking into the store. Pricing aggression from online players like Jio Mart and Big Bazaar etc.

Tracking Technicals:

In the recent sell-off along with border markets DMart stock price too plunged to below 1800 levels and quickly regained and headed to 52 week highs. After that Q1 results as well entry news of Jio Mart made stock to fall. Now it is in key juncture of 1980-2100 levels which will change the direction of stock. Stock will be bullish only any weekly close of above 2100. Till then it will be range bound to bearish side.

Disclaimer: The analysis made above is for educational purpose and not a recommendation. Data may contain type error and i am not responsible for the any errors and any decision taken based on this analysis.

#Technicals#Walmart#RetailSector#Growth#analysis#DMart#Companies