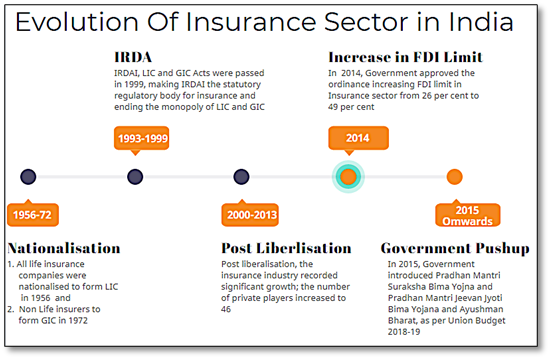

Post-liberalisation, India’s insurance industry has recorded a significant growth. The insurance industry of India has 57 insurance companies – 24 are in the life insurance business, while 33 are non-life insurers. Among the life insurers, Life Insurance Corporation (LIC) is the sole public sector company. There are six public sector insurers in the non-life insurance segment. In addition to these, there is a sole national reinsurer, namely General Insurance Corporation of India (GIC Re). Other stakeholders in the Indian Insurance market include agents (individual and corporate), brokers, surveyors, and third-party administrators servicing health insurance claims.

The insurance sector is broadly divided into two types 1. Life Insurance 2. Non-Life Insurance

Life Insurance

The life insurance industry has considerably evolved since it opened up for private players in 2000. India is ranked 10th in global life insurance business. India’s share in the global life insurance market is 2.61%

The gross premium collected by the life insurance companies in India increased from Rs2.56trillion in FY12 to Rs.7.31 trillion in FY2020 During FY12-FY20 premiums from new business increased at 15% CAGR to reach Rs.2.13 trillion.

Opportunities :

Life insurance has vast opportunities to grow. Let’s see

Increasing Working population :

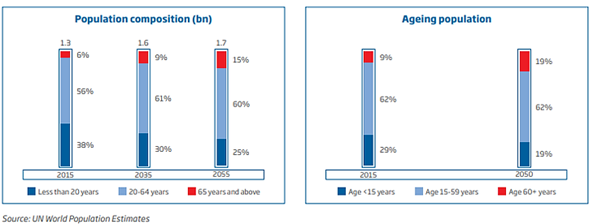

India is undergoing a demographic surge and by 2027, the country is predicted to overtake China as the world’s most populous country

India is going to have the highest working population by 2035 in the world, which has scope for a high insurable population.

Low Insurance penetration :

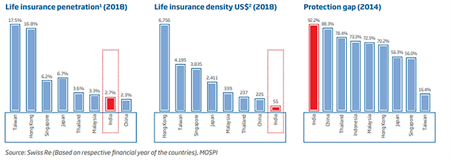

As compared to other developed economies, India remains vastly underinsured, both in terms of penetration and density. The ‘protection gap’ in India is among the highest in the world at 92.2% as of 2014. This, along with the evolution of the life insurance distribution model and rising awareness about the need for life insurance, enhances the opportunity

The protection margin for India was the highest among all the countries in Asia Pacific at 92%, as per a Swiss Re report. This means that for US$ 100 of the insurance protection requirement, only US$ 8 was actually insured. This indicates the absence or inadequacy of pure protection coverage (term insurance) for a large part of the population

Financial Savings :

Increasing preference towards financial savings with increasing financial literacy within the population

Various government initiatives to promote financial inclusion: Implementation of Jan Dhan yojana – around 398 mn new savings bank accounts opened to date Launch of affordable PMJJBY and PMSBY social insurance schemes

Atal Pension Yojana promotes pension in the unorganized sector

Digitization :

Technology today is evolving and disrupting businesses at a pace never seen before. With the increase in the flow of information, it became easy to create awareness about the products. It is estimated that digitization will reduce 15-20% of the total cost for the life insurance sector. Digital technology has the potential to break traditional barriers in the insurance sector like product awareness level, limited customer touch points, access to knowledge, service availability, and payments.

Market Players :

LIC is the clear monopoly till 2003 with a 98% market share. After the entrance of private players to the sector LIC started losing its market share. The private sector has a market share of 31.3% in FY 20

But still, LIC is the dominant player in the insurance sector with 68..7% market share.

Private Players :

- HDFC Life Insurance

- ICICI Prudential

Despite the recent COVID-19 outbreak dampening growth projections for economies across the globe, the structural story for insurance remains intact. Insurance remains a multi-decade opportunity in the Indian context and insurers are well poised to maximize the long-term growth potential of the industry.

Non- Life Insurance :

Non- Life Insurance :

The Indian non-life insurance industry has come a long way in the last two decades since the industry was opened for private participation in fiscal 2000. Liberalization was the first big change in the sector. Subsequently, in fiscal 2008, the industry witnessed another major change when most of the segments were detariffed.

Opportunities :

Large Addressable Market :

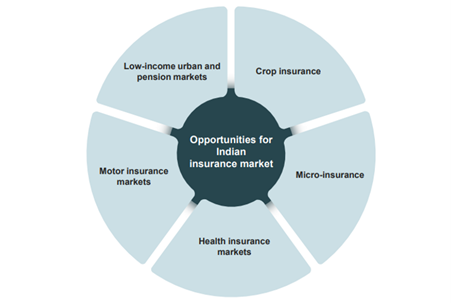

India is the 4th largest non-life insurance market in Asia and the 15th largest globally. Non Life penetration in India is 1/3th of the global average :

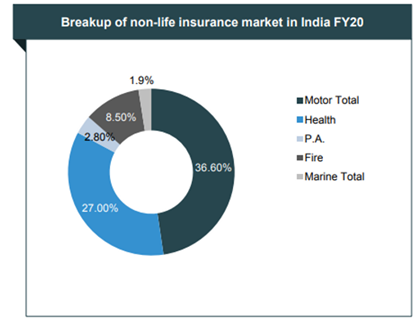

Breakup Of Non-Life Insurance :

Non-life insurance has motor insurance, health, fire, marine, and crop insurance. Motor insurance is the biggest driver of growth in non-life insurance.

In FY20, motor insurance constituted 36.60 percent of the non-life insurance market in India

Favorable Regulatory Developments :

In the last two years industry witnessed positive regulatory developments as follows Effective September 1, 2018, based on the Supreme Court judgment, all new private cars and two-wheelers are mandated to have a long-term third-party cover. The coverage is applicable for a period of three years for private cars and five years for two-wheelers.

The Regulator has also enhanced the minimum capital sum insured under Compulsory Personal Accident cover (CPA) for Owner-Driver liability to ` 1.5 million. This direction had been issued in the backdrop of the Madras High Court judgment. Subsequently, the Regulator issued a circular wherein the Compulsory Personal Accident (CPA) cover has been unbundled and de-tariffed effective January 1, 2019

The GST rate on third-party motor insurance premiums for goods-carrying vehicles was moderated from 18% to 12%. The amended rate is effective from January 1, 2019. The reduction in tax rate is expected to lower the cost of insurance, thereby making it more affordable and hence is a positive change for the General Insurance Industry

Health insurance :

Health Insurance is the second biggest market after motor insurance. It contributes 27% of the total non-life insurance. Only 18 percent of people in urban areas and 14 percent in rural areas are covered under any kind of health insurance scheme

The absence of government-funded health insurance makes the market attractive for private players. In August 2018, coverage of mental illness under health policies was also mandated by the IRDA

Crop Insurance :

Crop Insurance is the third largest contributor to total Non-Life insurance premiums.

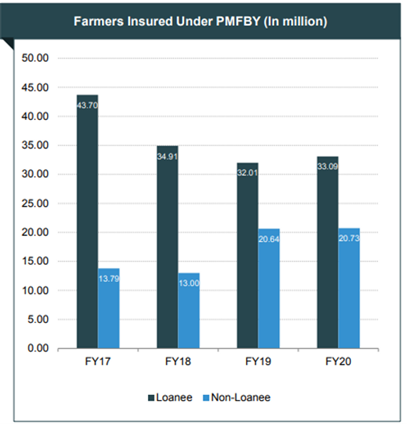

Awareness about crop insurance in India is 38.8 percent, and still, the crop insurance market in India is the largest in the world. Over 53.8 million farmers benefited under Pradhan Mantri Fasal Bima Yojana (PMFBY) in FY20.In September 2018, the Government increased the number of risks to be covered in the Pradhan Mantri Fasal Bima Yojana (PMFBY) to empower farmers in a better way. From now on, farmers will be protected against hailstorms, crop fires, damage from animals, landslides, and rainstorms.

Market players :

The public sector companies accounted for a cumulative share of about 45.30 percent of the total gross direct premium in the non-life insurance segment in FY19. ICICI Lombard is the largest player with a 15.6% market share among private sector players and 8.5 % in the non-life insurance industry.

Conclusion :

Overall insurance sector will become a significant part of the financial services industry in India. In the current pandemic situation, Banks and NBFCs will suffer from NPAs which reduces the profitability of the companies. Smart money might move from banking and NBFCs to the insurance sector.

Disclaimer: The above analysis is only for educational purposes only should not be considered as the recommendation. Please consult your financial advisor. Data may contain type errors and I am not responsible for any errors and any decision taken based on this analysis.

#growthopportuniiities #covid #india #opportunities #motorinsurance #lic #icicipru #Insurance #hdfclife #healthinsurance